Home Buying Insights for 2025

Hey Dr. Huedepohl! Is now a good time to buy a home?

Absolutely, yes!

But aren’t mortgage interest rates high?

Yes, but let’s break it down and understand what this means for you.

While I’m not an economist by trade, I know that my Town Square Mortgage team is here to answer your questions and provide personalized options. Let’s explore what experts predict for 2025 and how current trends could impact your buying power.

A Quick Word from Dr. Healthy Homes

When buying a home, making an informed decision is key to your long-term happiness and financial well-being. That’s why Dr. Healthy Homes emphasizes the importance of finding the right property that aligns with your lifestyle and financial goals. Want more expert advice and resources? Check out www.DrHealthyHomes.com to guide you through every step of your journey to homeownership.

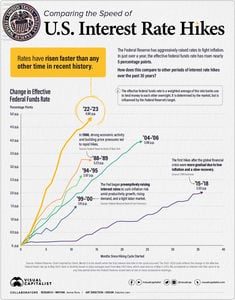

Comparing the Speed of U.S. Interest Rate Hikes

I recently attended a continuing education class offered by Independent Title called Monthly Market Matters, and one of the most fascinating topics we discussed was the chart “Comparing the Speed of U.S. Interest Rate Hikes.”

In just over a year (2022–2023), the Federal Reserve raised the effective federal funds rate by nearly five percentage points (4.88 p.p.), marking the steepest climb in the shortest timeframe since 1988–89. This rapid increase helps explain why mortgage rates feel so high right now. However, historical data reveals that today’s challenges aren’t without precedent—and buyers can still thrive in this market.

Why the Rapid Increase Now (2022–2023)?

The Federal Reserve raised rates aggressively to combat high inflation, which surged due to factors like pandemic-related supply chain disruptions and increased consumer demand. Inflation control is the primary goal of raising rates because higher rates make borrowing more expensive, slowing down economic activity.

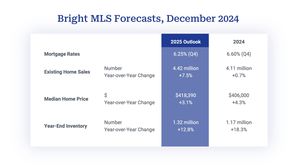

National Housing Market: A 2025 Snapshot

While the DFW market is full of opportunities, it’s helpful to zoom out and consider the national housing outlook for 2025. According to the Bright MLS 2025 National Housing Market Outlook, next year will be shaped by competing forces:

- Pent-Up Demand & Supply: Buyers and sellers waiting for favorable conditions could lead to an uptick in market activity.

- Economic Uncertainty: Rising consumer debt, high home prices, and moderate wage growth may challenge first-time and moderate-income buyers.

Key National Trends for 2025:

- Mortgage Rates: Rates will gradually decline, averaging 6.25% by Q4 2025, though they will remain higher than pre-pandemic levels.

- Home Sales: Existing home sales are expected to grow 7.5% yearly, reaching 4.423 million transactions. However, this is still below the long-term average of 5.2 million sales annually.

- Home Prices: Home prices will increase by 3.1%, bringing the median price to $418,390. Growth will be slower, but higher-income markets may see stronger appreciation.

- Inventory: Inventory will rise 12.8%, with 1.32 million homes projected by year-end. However, supply will remain below pre-pandemic levels.

Key Takeaway

Inventory is rising nationally, but affordability challenges persist. Acting sooner could allow buyers to secure better value before conditions shift further.

What This Means for DFW Buyers

While national trends offer valuable context, the real estate market is local first. Buyers have unique opportunities in DFW, where growth is robust, and demand is steady. Inventory is expected to grow nationally, but local dynamics—like population growth and economic strength—will ultimately shape affordability and availability.

Why Waiting for Lower Rates Could Cost You More

When interest rates go down, many people think, “Great! I’ll wait to buy a home until rates drop!” But here’s the catch: when rates go down, home prices tend to go up—and here’s why. When rates are lower, more people can afford homes, increasing demand. With more buyers competing for homes, sellers can raise their asking prices. This means the same house you’re looking at today could cost significantly more tomorrow if rates drop.

For Example:

- When rates are higher (like today), Buyers face less competition because fewer people are willing or able to buy. This keeps home prices more stable or even negotiable.

- When rates drop: Buyers flood the market, and homes often sell for more than their asking price due to bidding wars.

What Does This Mean for You?

Let’s say you’ve budgeted for a $2,500 monthly payment. If you wait for rates to drop:

- Higher Home Prices: You may no longer be able to afford the same house because its price will have increased.

- Less Buying Power: Even with lower rates, your budget will not stretch as far because prices will likely rise faster than your savings.

Bottom Line

While higher rates might feel intimidating, today’s market offers a chance to buy at a more reasonable price. And remember, you can always refinance to a lower rate later when rates drop. But if you wait, you could pay a higher price for the same home.

What Does This Mean for You?

What matters most is finding a home you love and ensuring the monthly payment fits your budget. Rates might feel high now, but here’s the good news: rates can always go down later, and you can refinance to a lower rate. Buying a home remains one of the best long-term investments, and my team is here to help guide you through every step of the process. You don’t have to navigate these numbers alone!

I Don’t Have a Crystal Ball, but I Do Have Champagne!

While we can’t predict where rates will go next, we can celebrate finding the perfect home for you. So, let’s pop that bubbly and toast to your new chapter! 🥂

Be healthy. Be Happy. Be Home.

Cheers!

Dr. Huedepohl

Need More Information?

Visit www.DrHealthyHomes.com for resources, tips, and expert guidance. If you’re ready to start your journey or have questions, contact Dr. Healthy Homes today!

📞 Contact Us: 612-202-3519

📧 Email Us: [email protected]

Part 2 Teaser: What’s Next?

Stay tuned for Part 2: “DFW Market Update: What’s Happening in Our Backyard?” We’ll explore the latest trends and statistics shaping our local real estate market.